Roughly half of the people (that includes you Millennials) who have Health Savings Accounts (HSA) do not know that they can invest and grow money using their HSA dollars. I am here to tell you that YOU CAN (yes, I am yelling), and I’ll show you prove of my HSA account and how it’s yielding. It’s good stuff!

Roughly half of the people (that includes you Millennials) who have Health Savings Accounts (HSA) do not know that they can invest and grow money using their HSA dollars. I am here to tell you that YOU CAN (yes, I am yelling), and I’ll show you prove of my HSA account and how it’s yielding. It’s good stuff!

Before I show you my HSA account, I just want to say “START INVESTING IN YOUR HSA N-O-W!” and yes, I am yelling again.

- It takes less than 10 minutes to sign up and you need only do it once (unless you are one of those savvy investors who want to re-balance their own portfolio, which I personally do)

- then forget about it

- and once in a blue moon when you remember that you have an HSA account, log on and see your money grow

- Feel the satisfaction of having free monthly money without getting your hands dirty!

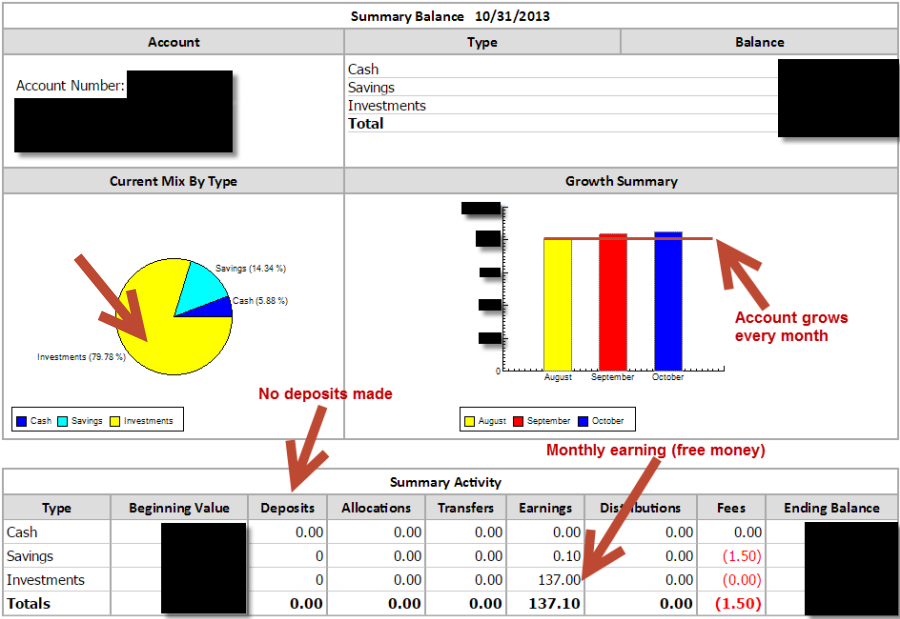

My HSA overview is below. Some information is removed for my account privacy ![]() . I currently cannot contribute to an HSA account (since October 2013) as my current company does not offer the high-deductible health plan that qualifies for the HSA, BUT….I am gaining $$$’s every month from my old HSA account from my previous company. That’s the beauty of HSA accounts! That money is all yours and you can continue to grow the money even after you can no longer contribute to the HSA account.

. I currently cannot contribute to an HSA account (since October 2013) as my current company does not offer the high-deductible health plan that qualifies for the HSA, BUT….I am gaining $$$’s every month from my old HSA account from my previous company. That’s the beauty of HSA accounts! That money is all yours and you can continue to grow the money even after you can no longer contribute to the HSA account.

Notice that I put more money into the Investments account and less money into the Savings and Cash accounts. I adjust these based on how aggressive I want to be with my account (my portfolio is very Aggressive because I am young and greedy ![]() ). What is the difference between these accounts?

). What is the difference between these accounts?

- Cash - money from this account will be used to pay for any qualified medical expenses that you incurred. My HSA custodial requires that I maintain a minimum of $500 in my Cash account, although I do not spend any of my HSA money

- Savings – a savings account that you gain interests on your monthly balance (like a near 0% interest; not worth it to put money here). My HSA custodial requires that I have some money in my Savings account and thus I have some money in here. They deduct the monthly investment fee of $1.50 from this account

- Investments – investment account to use to grow your HSA $$$’s

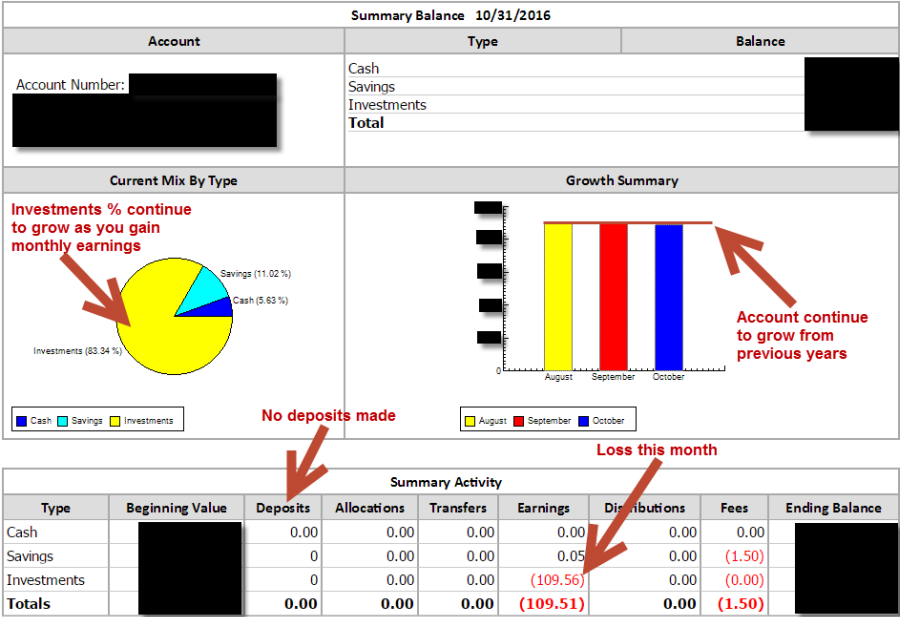

Now I am going to jump forward to October 31, 2016:

Although the change is very subtle, you can see from the bar chart that the money is increasing every year, as compared to the account overview from October 31, 2013.

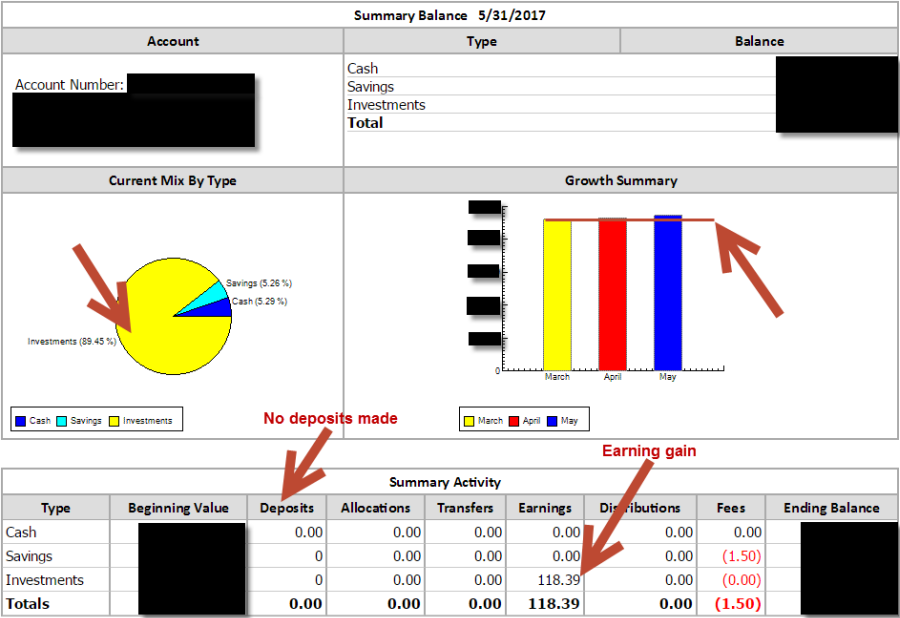

Now I'll show you the most current overview May 31, 2017:

As you can see, I am getting $100+ of free money every month doing nothing (and a very few losses, which is to be expected). This does not seem a lot but this is free money that you do not have to put in a sweat to get! So yes, that $100+ per month is a lot! Can you get this kind of earning having cash in your bank?

For those people whose company provides HSA and have not sign up, SIGN UP NOW and make those $$$’s grow! Consider yourself fortunate that you can open an HSA account as not all companies provide this option. You will thank yourself when your pretty, luscious, dark hair turned all snow white.

Contribute the maximum amount allowed, if possible (individual and family have different maximum amount) as you are getting tax-free money and the gain that you get from your investment is also tax free. Remember, the more money you have to invest, the more gain you get every month.

Depending on the company that manages your HSA account, there might be a minimum amount you must have in your HSA account before you can invest. The minimum amount required is often very low, between $0-$2500. My account requires a minimum of $1000, whereas, my sister’s account (yes, I made her sign up to invest!) does not have a minimum.

Also depending on your HSA custodial, there may be a monthly or annual transaction fee. My account has a monthly transaction fee of $1.50, whereas, my sister’s account does not have a fee.

One last note and I promise to stop blabbering, if you have a Flexible Spending Account (FSA) in addition to the HSA, use the money from your FSA for qualified medical expenses and leave the HSA money alone. Unlike the HSA, you cannot invest using the FSA dollars, and if you do not use up all the money at the end of the year, you lose that money.

I hope you learned something new today. Feel free to add any comments. Thanks for reading and have a good one.

Disclaimer: All content is the opinion of the author. No investments is guaranteed to generate income. Please do your own research before you jump into anything crazy. Invest at your own risk.

Credits: www.irs.gov, www.healthcare.gov